What is NPV or Net Present Value ?

NPV or Net Present Value is a financial metric in capital budgeting that is used to evaluate whether a project or an investment is going to yield good return in future or not. It can be simply represented as the difference between the present value of cash inflows and the present value of cash outflows. In the long run a positive NPV value indicates good potential return over investment, while the negative NPV value means that the investment is likely to loose money. Sometimes NPV is also referred as NPW or Net Present Worth.

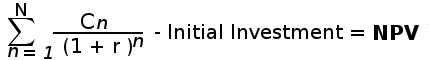

NPV calculation formula :

For calculating NPV value using formula, you must already know the estimated value of discount rate (r) , all cash flow (both positive and negative) and the total initial invesment made by the company. The formula for calculating NPV is as follows:

Where in the above formula :

N = total number of periods

n = positive integer

C = cash flow

r = discount rate

NPV = net present value

Calculate NPV with Example :

Suppose a company wants to start a new manufacturing plant in the near future. The company is looking forward to invest a total sum of $100000 in it's setup at the beginnning, where the expected discount rate is 10 percent per-annum. This company has set it's goal for 5 years and for these 5 years the cash flows are - $10000, $20000, $30000, $40000, $50000 respectively. Let's calculate the NPV and also evaluate whether the company should pursue this decision or not.

The equation we have :

NPV = C1/(1+r) + C2/(1+r)2 + C3/(1+r)3 + C4/(1+r)4 + C5/(1+r)5 - initial investment

Let's apply all the known values in the NPV formula here.

NPV = 10000/(1+0.1) + 20000/(1+0.1)2 + 30000/(1+0.1)3 + 40000 /(1+0.1)4 + 50000/(1+0.1)5 - 100000

NPV = 6525.88

The positive value of NPV suggests the investment is likely to return profit in the future. In this scenario the NPV is 6525.88, so it seems that the investment is likely to yield profit.

NPV decision rule :

If NPV > 0 , then the company should accept the investment decision or project. The positive value of NPV is expected to increase the net worth of the company or it's shareholders.

If NPV < 0 , the company is expected to loose the money, so it shouldn't pursue that investment or project.

If NPV = 0 , this will neither increase or decrease the value of the company or firm.

Drawbacks of NPV :

The discount rates (r) used in the formula above are likely to vary over time. The slight increase or decrease in discount rate can impact the NPV value. Hence it's critical in decision making.

NPV is not effective in comparing two mutually exclusive projects which require different amount of investment.

NPV may not give correct decision when comapring two projects with different time duration.

NPV calculation is based upon assumptions. It's prone to forcasting error. So, companies can't rely on only NPV before making any investment decision. There's other financial tool too (like IRR or Internal rate of return) which companies should consider for getting the clear pictures.

Further Reading Suggestions:

- NPV vs IRR: Which is better for capital budgeting?

- NPV calculation in excel

About this NPV Calculator

Calculating NPV can be a very daunting task, specially when you have so many positive and negative cash flows. There's many tool available that can be used to calculate NPV. You can either use financial calculators like Ti-83,Ti-84 and HP 12c calculator or can take the help from softwares like MS Excel. This website, npvcalculator.info is such tool. It's an online NPV calculator.

To calculate NPV or Net Present Value, enter the initial investment, the expected discount rate and cash flows for each period. You can also add or delete period fields as needed. Then hit the calculate button to get the NPV result.

Our Other Financial Calculators:

- SIP Calculator : To calculate return on mutual fund systematic investment plan.

- IRR Calculator : To calculate the internal rate of return

- CAGR Calculator : To calculate the compound annual growth rate for an investment.